The Challenge: Making Banking Engaging & Contextual

Traditional banking apps overwhelm users with complex forms and disconnected data. The goal here was to:

✅ Turn passive users into active investors.

✅ Make financial data digestible and actionable.

✅ Create an experience that educates while guiding users to their goals.

✅ Make financial data digestible and actionable.

✅ Create an experience that educates while guiding users to their goals.

To achieve this, I worked directly with banking teams to uncover what mattered most:

1️⃣ Shared Data Concerns – Ensuring transparency across user accounts while keeping data presentation personalized.

2️⃣ Segmented but Contextual UX – The app needed to operate in segments for various financial services, but users should always see information in context of their goals.

3️⃣ Frictionless Learning & Onboarding – Users shouldn’t just enter data but understand why it’s needed and how it benefits them.

2️⃣ Segmented but Contextual UX – The app needed to operate in segments for various financial services, but users should always see information in context of their goals.

3️⃣ Frictionless Learning & Onboarding – Users shouldn’t just enter data but understand why it’s needed and how it benefits them.

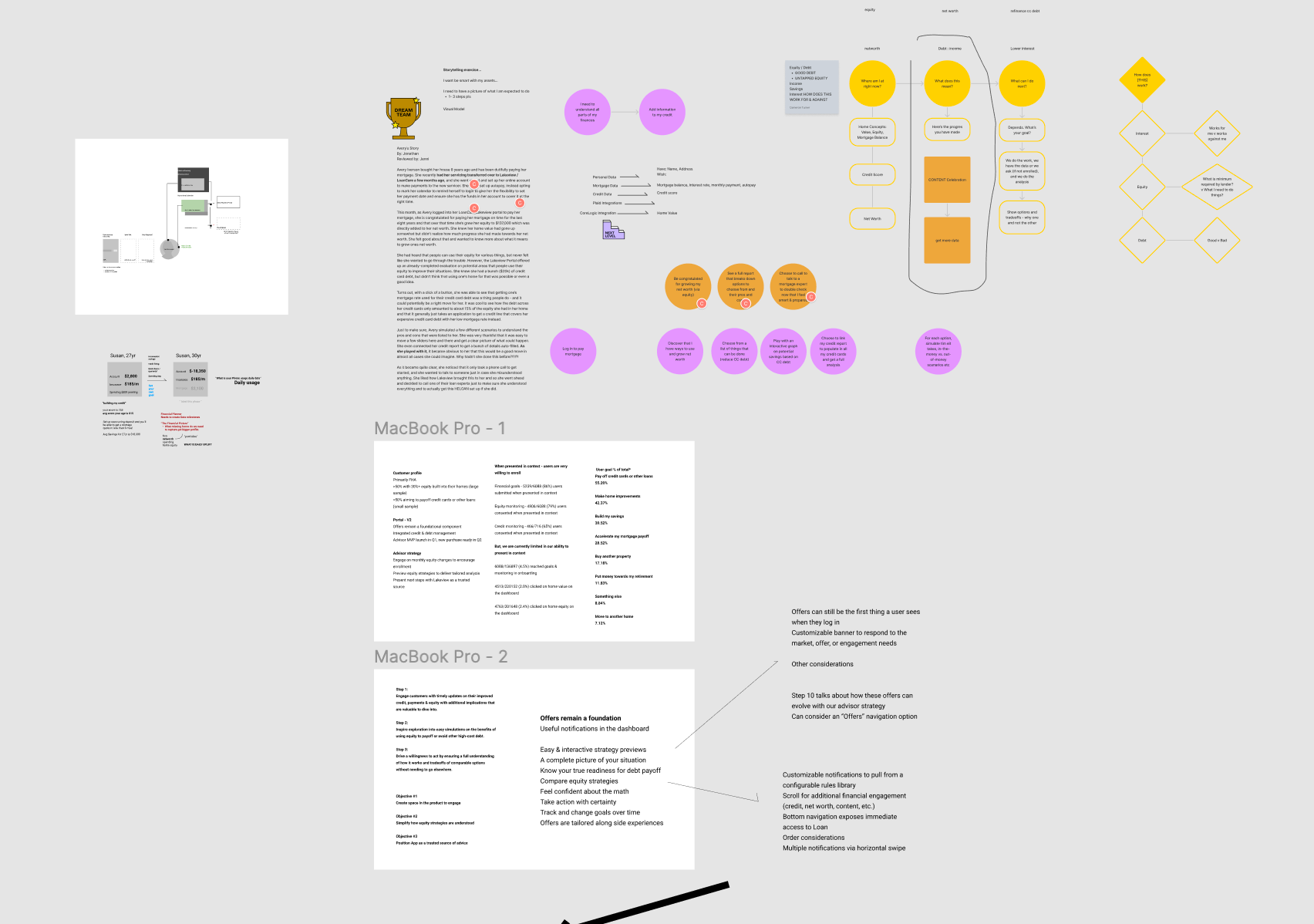

Working Backwards: Research & User Pathing

A deep research process allowed us to break the experience into four key phases:

🔹 User Needs & Pathing – Mapping how different user types engage with financial tools.

🔹 Distill All User Outcomes – Identifying the highest-priority financial goals users have.

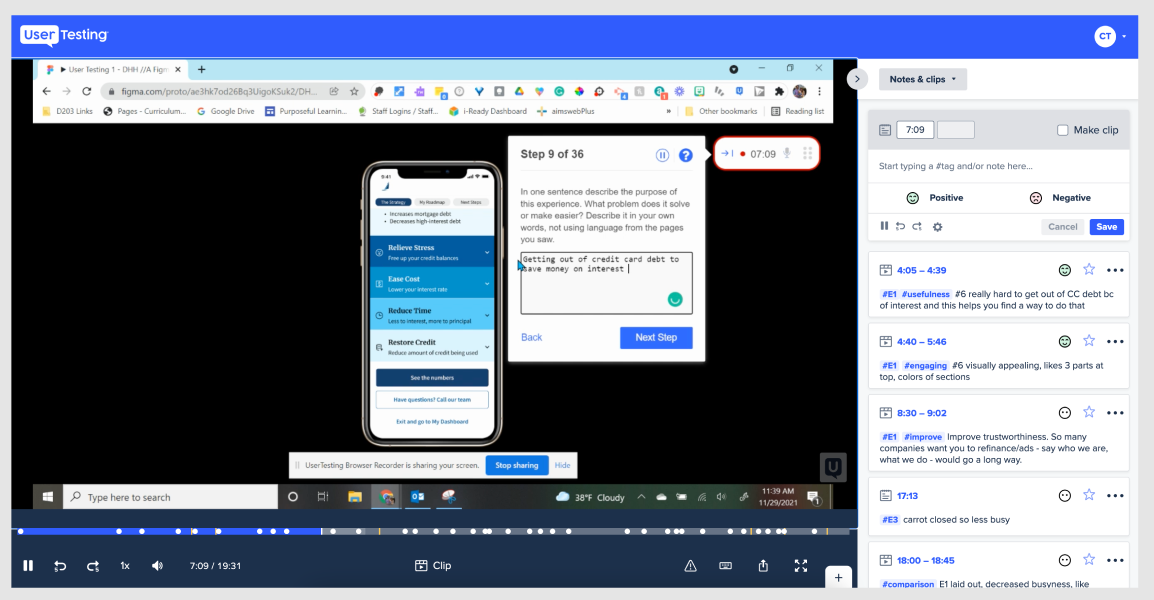

🔹 Test Pathing Against Priority Outcomes – Ensuring the user flow guides them towards their goals without friction.

🔹 Simplify – Stripping away unnecessary complexity while maintaining engagement.

🔹 Distill All User Outcomes – Identifying the highest-priority financial goals users have.

🔹 Test Pathing Against Priority Outcomes – Ensuring the user flow guides them towards their goals without friction.

🔹 Simplify – Stripping away unnecessary complexity while maintaining engagement.

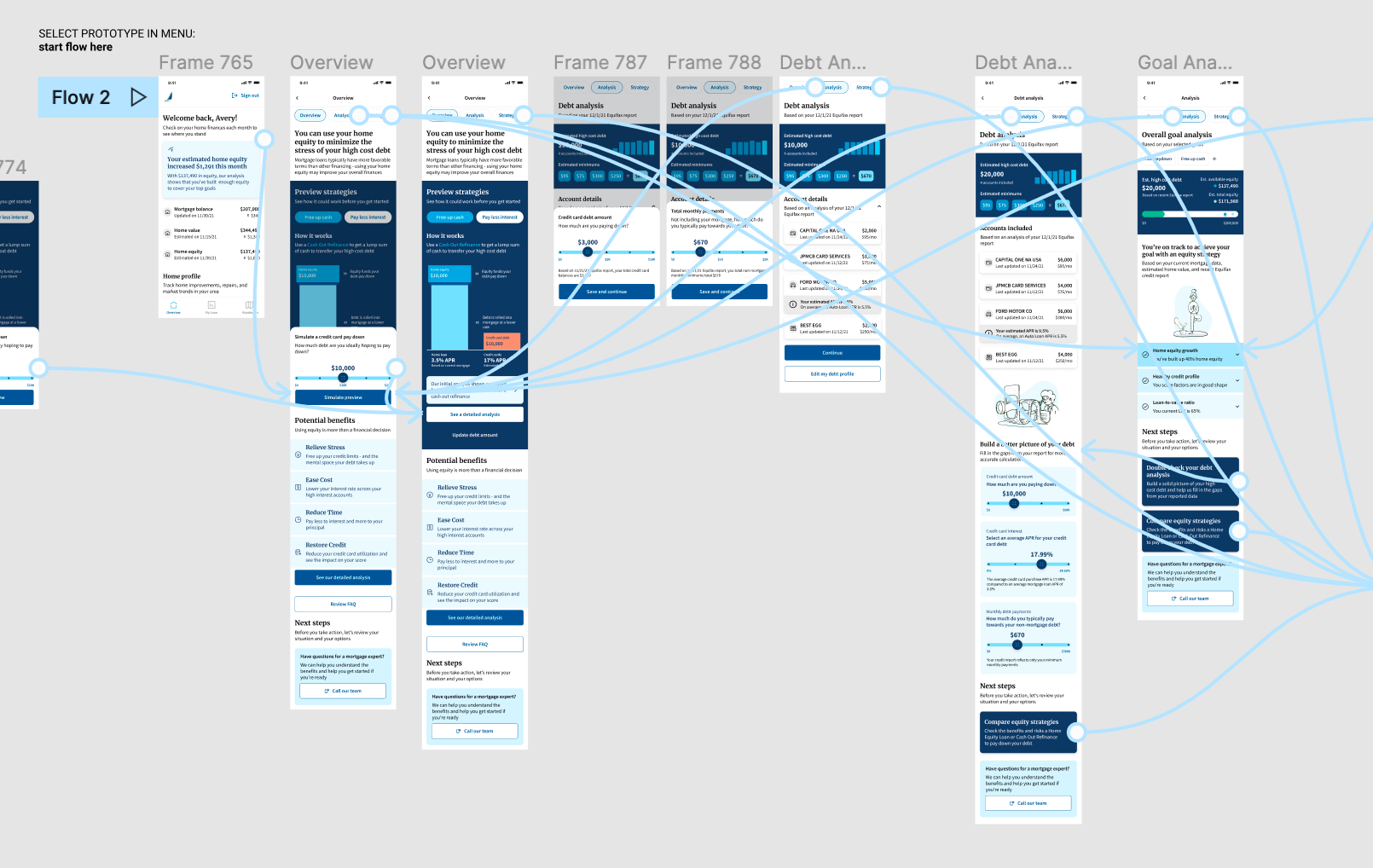

Execution: A Personalized Banking Experience

We designed an interactive, guided financial journey where:

✅ Users choose a financial path that aligns with their goals (investing, saving, debt reduction, etc.).

✅ Contextual learning is embedded into the experience, explaining each step instead of just asking for data.

✅ Personalization adapts in real-time, adjusting insights based on user input.

✅ Contextual learning is embedded into the experience, explaining each step instead of just asking for data.

✅ Personalization adapts in real-time, adjusting insights based on user input.

This approach removed the cold, transactional nature of traditional banking apps and replaced it with a dynamic, user-driven system. Instead of filling out endless forms with no feedback, users received insights and guidance along the way—giving them a sense of ownership over their financial choices.

Results & Impact

Increased user engagement by making financial planning feel interactive rather than bureaucratic.

Enabled smarter investing decisions by helping users connect their data to real outcomes.

Created a clear LTV model that users could see and understand, strengthening trust in the platform.

Simplified data collection while enhancing transparency, reducing user frustration with traditional banking forms.

Final Takeaway

By merging design strategy, behavioral insights, and game mechanics, we redefined the mobile banking experience—turning Glorifi into a platform where users feel empowered, not overwhelmed. 🚀